On September 26th, 2017, the conference of MARINE MONEY SUPERYACHT FINANCE FORUM, where we participated, took place in the upper halls of the Café de Paris in the city of Monte-Carlo, Monaco.

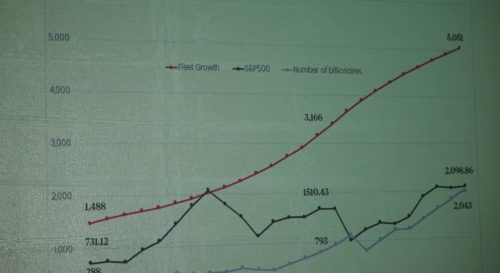

The first speaker was Mr. MARTIN REDMAYNE, President of LE GROUPE SUPERYACHT, who aimed to explain the changes in the industry over the last 25 years, an increase of the fleet from 1,488 to 5,054 ships; increase of S & P 500 (500-stock indicator of 500 Standars & Poor Index) from 731.12 to 2,098.86; and an increase of billionaires from 288 to 2043.

The Superyacht Group

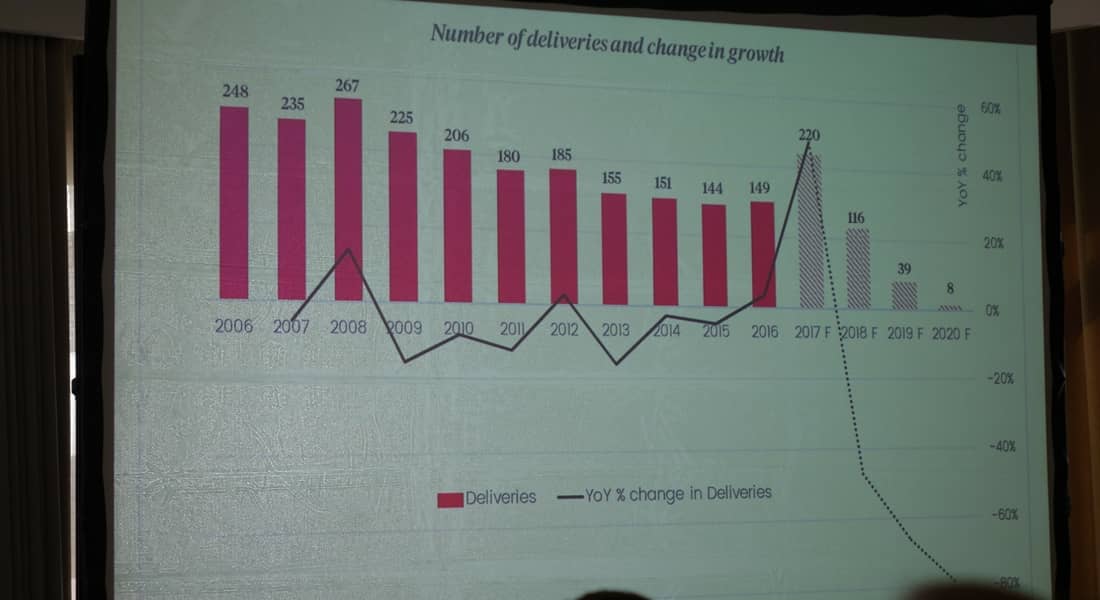

The speaker pointed out that there is a constant and stable increase of yachts in construction from 2016 to 2017, however, for the future years, this analyze precise what show the indicators. The new construction yachts will decrease dramatically. However, this contradict statistics indicate that the increase has been stable and now there are more billionaires.

In terms of sailboat sizes, the number of construction orders of 30 to 45 meters yachts is currently the highest, followed by orders of 45 to 60 meters yachts and orders over 60 meters yachts; which means that all sizes of yachts have had an increase in orders. Statistically, so far this is the best year after the banking debacle of 2008.

In the presentation, MARTIN REDMAYNE showed the statistics on the sell and value of the yachts during the past 5 years. In near 10 years (2017-2027) the increase of fleet from 5212 to 7004 is predicted.

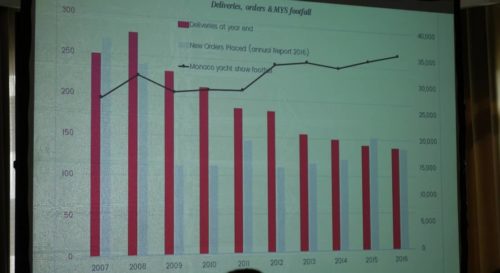

Nevertheless, the statistics show that the shipping, orders and effect of MYS on the sales of yachts decreased until 2016.

The most interesting aspect of MARTIN REDMAYNE's exhibition, in addition to the statistical analysis, is his vision of the job, since he knows what the future owner of a yacht wants and how to sell a yacht or convince him not to buy it, but to rent one. As in all business strategy, knowing the customer is essential, in this business this maxim is fully applied.

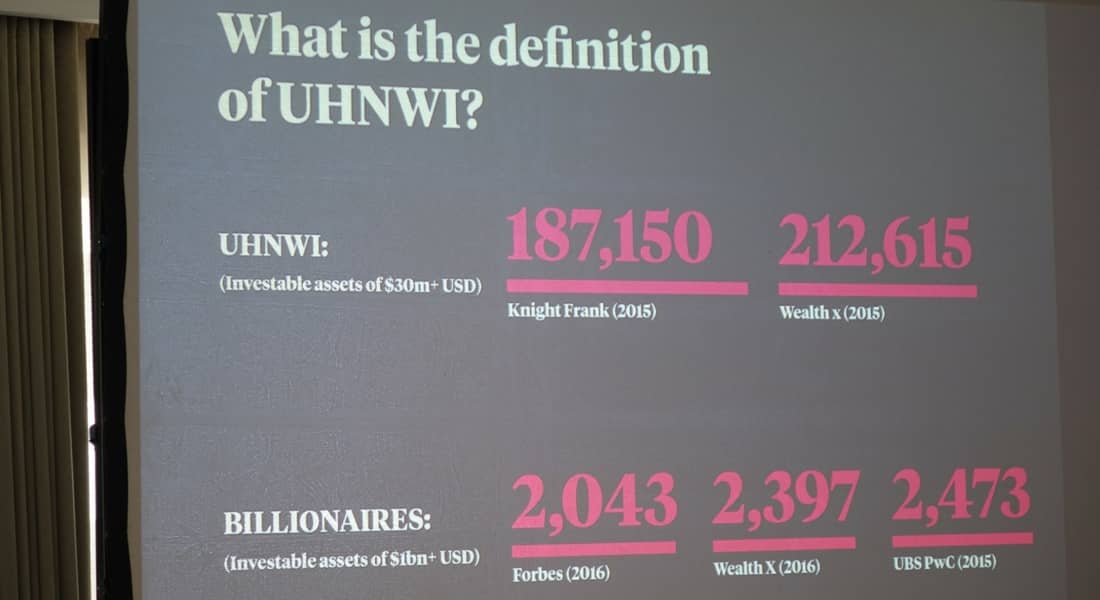

Knowing what 1% of the world's population (200,000 customers worth $ 30 million) is looking for before deciding or choosing a registry for their yacht is fundamental to establish the right policy we should follow in the future.

Our future clientele is made up of a small group of just over 2,000 persons called the Billionaires Club, whose demographics are also defined. All of this is explained in detail in the slides and audio of this speaker's intervention.

Vessels Value

Subsequently, the VesselsValue enterprise, through one of its partners, SAM TUCKER, briefly introduced the services and the importance of giving value to a ship at the best time, whether it's of a commercial vessel or a super yacht. This company is composed of lawyers, brokers, insurers, builders, financiers, charter advisers, flag registers, accountants, port authorities, subscribers, readjustors, auditors and operators.

In parenthesis, I make the reservation that the government of Mr. MACRON wants to implement a new fiscal policy by which the payment of taxes to owners of super yachts, luxury cars and other goods is exempt, because it is precisely these millionaire investments that make the Côte d'Azur, the richest region in France and in Europe, where, side by side, there are cities (Cannes, Nice, Antibes, Saint-Tropez, Monaco, Saint-Raphaël, Menton , etc.) that welcome the richest people in the world. Precisely, the MACRON government wants the luxury yacht industry to produce work and services for a large part of the population.

INCE & CO, International Law Firm

Panel: Legal, Tax and Regulatory Review: Moderator: Andrew Charlier, Partner, Ince & Co. Law Firm.

In the presence of tax experts from France, Malta, Spain and Italy, the following panel was set up regarding the most relevant points:

France: Speaker: Jean-Philippe Maslin, Partner, Ince & Co. Law Firm.

It does not change in terms of taxes, but with regard to the social security of seafarers, who must have a social security system of ships that are not from the European Union and to join the French social security, which is a problem for yacht owners. They want to modify the standard allowing the sailor to choose his affiliation, or French or private, but this norm has not yet been modified because France does not allow private social security and this option does not exist, because of the fears of the destruction of the French social security system.

With regard on commercial vessels and private vessels, there have been two changes in the "Custom Union Code" that will come into effect next year, the first is a new tax declaration when the ship enters France and when it is imported for the first time, and the boat must have the tax declaration in order.

The second, the ship must have a letter from the authorities on board which gives him permission to sail in the country where he was. In 2015, for commercial vessels in France, there was a change of interpretation of tax exemption legislation and benefiting for imported vessels and those operated with VAT in France have an exemption. So far, no changes have been made to the legislation for commercial or private yachts.

Charter, the 70% is calculated on the amounts of the trips, not on the destinations of the voyages, it is necessary to cross or to leave French waters. It is necessary to qualify the charter trip according to the list of passengers and the passenger boarding ports. The commercial activity is calculated on the calendar year not the last 12 months, for that it is not recommended to move the boat in France in November or December, since are the last months of the year to benefit from the exemptions. If you import the yacht in December, it is not possible to benefit from VAT exemption from January 1, even if all the conditions required to obtain 70%, are complied.

Your vessel will not be registered for a private use, but as a commercial use and you always pay VAT and VAT for supplies, but it can be refund if it is used throughout the year. With the Custom Union Code, you can cancel the payment of import taxes (VAT) and 70% of the yachts for commercial use. In France, the exemption from VAT for the contract for passenger transport that has an international destination does not cross international waters, which is very attractive.

Spain: Speaker: Miguel Ángel Serra Guasch, for Albors Galiano Portales.

There are no changes in Spanish legislation, no VAT tax cuts, or any possibility of reducing the cost of chartering what is in the open sea as to the collection of taxes for the Spanish government. For the moment no agreement with the government is established between the associations and the Ministry. They want a resolution on "Yachts with the NON-EU flag, but with EU status sailing out of the territory where they pay taxes, for example the Caribbean and when they return with their assets, they have to pay taxes, there are the rules that involve the payment of VAT between 20 and 25 million euro or give the guarantee to the same amount. Otherwise the boat is sequestrated until the payment is not made, this was the first problem in 2013. The Union Custom Code must be changed, but the European Union does not intend to change the temporary admission, however Mr. Serra thinks a lot has already been changed.

For example, the temporary admission of yachts is a maximum period of 10 years, but they do not know from when this account starts, or if you have to do a restart in the case of change of ownership or sale of the boat, how long the boat can stay in the waters of the European Union.

Another important aspect is the possibility of using the yacht as a charter, it will depend on the national authorities of each state, for example in Spain, if there is a temporary admission the ship can be used as charter, on the contrary in Italy it is not possible.

Also, entering the territory requires a verbal statement, but in fact it is written and is not explained because it is so, but it is. There is the possibility of not making the declaration, in this case when entering the port the ship must be accompanied by the customs facilities and this gives you the proof that it is there.

Charters: There are charters in Spain, because with the government of the Balearic Islands was negotiated that the charter license changes, which has greatly simplified, until now the no EU needed a government authorization, and now all it takes is an affidavit, done before an authority of responsibility and that has all the documents in the order. Now, there are no differences between non-European and European yachts. Before, this statement was for one year, now it's for two years from January 1st, 2018. During this time only for a year and they will make a statement and it's better for owners and for all. There are already many yachts with applications for the year 2018, for Spain and the Balearic Islands which have chartering opportunities. They have nothing to pay, nor the administrative costs for the declaration or the permanent establishment.

That's why there was a 25% increase last year. Before the summer of 2014, Spain was not in the market, but it eliminated the registration taxes, the growth of the number of yachts and even more the big yachts, this growth has been spectacular last years, only in the Balearic Islands, there are hundreds of yachts.

Registration fees: Only yachts up to 15 meters in length, before October 2014, were tax exempt in Italy before there were mega yachts. Now this limit has been removed and there are no limits. They can claim a refund within 4 years from October 2013, but now it’s not possible. This tax cannot be completely eliminated, for political reasons, such as not taxing wealth. The amount of the receipts represents 10 million euros on the whole Spanish territory and in the Balearic Islands less than one million. This means that commercial yachts are entitled to exemption from the registration tax.

Malta: Dr. Alison Vassallo, member of the law firm Fenech & Fenech Advocates

Nothing has changed the products, they are identical, they are lightweight, so Malta is so successful and our customers want certainty, which is why we have hundreds of yachts. The most important change we have had in recent years is the increase in demands to insure the crew in Malta, there is a great interest in saving the yachts in Malta, more than anything that reflects what happens in the North.

Charters: In 2014, they started in Malta and private yachts were allowed 90 days for commercial use as charterers. VAT is calculated according to the perceived use of the yacht and the use of the type. Malta cannot be compared to other destinations that use Charters and the tax rate change, but it will not bring more customers. Malta has a unique offer, but it has geographical limitations, so it is not attractive to customers.

Italy: Ezio Vanucci, partner of the law firm Moores Rowland.

This year they did the Genova Boat Show, they presented the new tax guide approved by the tax office with a partnership called Usina and you can see all the taxes on the website, and the tax exemption in Italy, which came into effect in January 2017. It also advises companies that wish to apply for these tax exemptions. There are important export formalities requirements for yachts for international waters, but not for ports that are not ports of the European Union. There are problems of interpretation in the shipyards building ships for international waters, the new procedure of the Customs Code can benefit from the commercial exemption.

Another problem regarding commercial yachts that had a problem this summer, an Italian shipyard sold a yacht to a European Union company that does not know if the new Italian trade legislation or the current intra-Community regulations are enforced because that this is a commercial intra-community transaction, because physically the yacht had to be delivered to another territory within the European Union, the new Italian legislation is not applicable.

Charters: They must precise the technical characteristics and whether the yacht will sail in international waters or not, if it has left international waters. 70% have to be calculated by the notes of voyage, for example: two ports between the international waters.

Also, the other following commercial panels have been presented:

Vistra Marine & Aviation

Where do the customers come from (these days)?

Moderator: Dr. Anthony Galea, Managing Director of Vistra Marine & Aviation

The panel formed by:

Speaker: Harriet Reid, Partner, Groom Hill Company

Speaker: Robert Allen, Lawyer at Robert Allen Law Law Firm

Speaker: Mark Vermeulen, Product Manager of Damen Shipyards Company

Speaker: Roberto Giorgi, Executive Chairman, Fraser Yachts Company

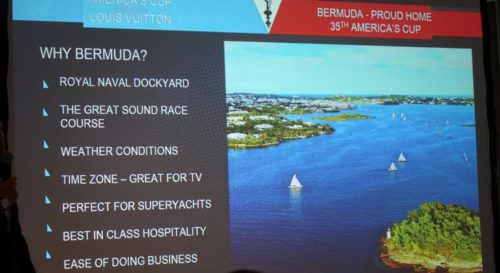

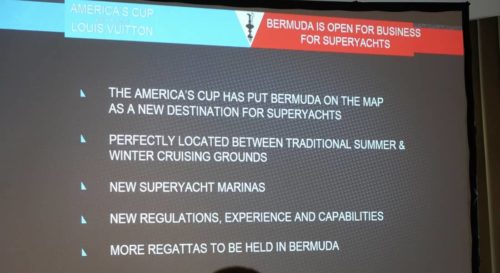

The huge success of the America's Cup in Bermuda and the impact of the event

Speaker: Sam Hollis, Commercial Commissioner and Chief Operating Officer, 35th America's Cup

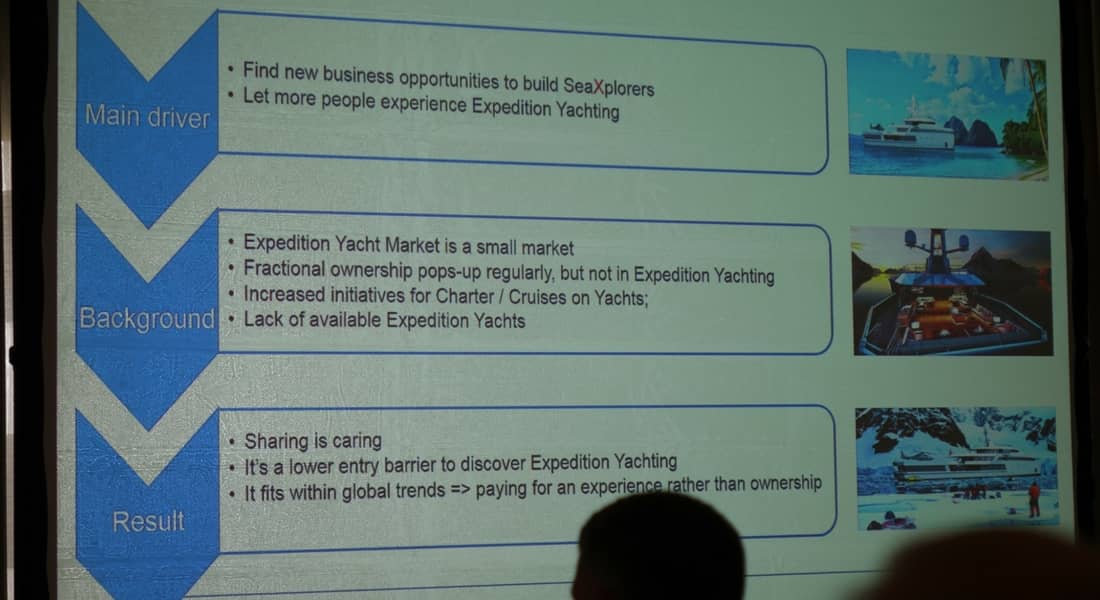

Panel Expedition Yacht Market

Moderator and speaker: Anthony Buneta, Head of Mega-Yacht Financing and Business Jet of Societe Generale Private Bank (Monaco).

Speaker: Ben Lyons, CEO of EYOS Expeditions

Speaker: Peter Robert, Director of Business Development and Market Information for Damen Shipyards Group.

IN CONCLUSION: As Panama is a financial center, the financing portfolio, mortgages, guarantees, etc. for yachts, it could be an important source of revenues for the public and private sectors. In the "Trends in Superyacht Finance: Transactions, Structures, Options and Opportunities" panel, the terms and conditions offered by the four largest banks in the sector to finance new construction were presented. BNP Paribas, ING Bank, Bank of America and Societe Generale Private Banking in Monaco offer loans differing from 5 to 7 years and exceptionally 15 years, as a percentage that they give to the yacht as collateral for the loan, as a percentage of the loan of capital that they finance varies from 50% to 100% according to the Bank. Normally, these offers apply to a Yacht or Private Jet or both, depending on the customer.

The participation on this conference allowed me to meet the important number of lawyers and enterprises companies with which we are in contact, that as we hope, will be useful for the Consulate in the future.

An important fact that I must emphasize is the participation of the most important registers of yachts in the Marine Money that is CAYMAN REGISTRY, MARSHALL ISLANDS, BERMUDAS, etc. From Business Development Management, Yachts International Registries, Inc., affiliated with The Maritime & Corporate Administration of the Republic of the Marshall Islands, recruits each year its best staff.

Finally, this is a summary "grosso modo" about the most important information that must be highlighted from the 2017 MARINE MONEY SUPERYACHT FINANCE FORUM.

Consulate General of Panama

Consulate General of Panama